Explore the faculty research, thought leadership, and groundbreaking philosophies that established Michigan Ross as one of the world’s top business schools.

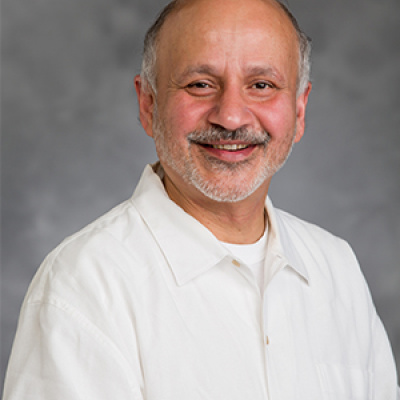

Professors Norman Bishara and Jagadeesh Sivadasan have made significant contributions to influential literature examining the variation in the enforceability of non-compete clauses and their consequences. Their work is an important part of broader literature documenting monopsony power (i.e., the power of employees to set wages leading to a redistribution of surpluses away from workers), worker mobility, and knowledge transfers. In a pioneering paper published in 2010, Bishara created a detailed rating of the non-compete enforceability in all 50 states, building on painstaking work parsing the regulations and case law at the state level. The enforceability index from Bishara's 2010 paper, combined with worker-quarter-level U.S. Census data, was used in a paper by Sivadasan and co-authors to show that higher enforceability is correlated with lower wages and mobility for tech workers.

Bishara and his U-M coauthors also undertook a broad survey of U.S. workers, documenting for the first time the surprising prevalence of the use of non-compete clauses across a range of industries, including for low-wage workers, as well as work showing the chilling effect of noncompetes on employee behavior, even when they are unenforceable. This portfolio of work helped spark a major policy debate about the use and abuse of noncompetes that inspired action from the White House and the research conclusions being cited in the 2023 State of the Union Address, and spurred a report from U.S. Treasury Department, legislative changes from numerous states, and research from a range of think tanks that eventually led to the 2024 final rule from the Federal Trade Commission attempting to ban noncompetes in employment contracts across the country.

Beginning from seminal efforts by Brian Talbot at the Michigan Business School in the early 1990s, the Tauber Institute for Global Operations was designed to bring business and engineering students together for a world-class education in operations. Students would take classes in both business and engineering and complete team projects with companies. The projects were scoped to incorporate both business and engineering content, addressing important problems that had a VP-level champion at the sponsoring company. The institute was innovative by offering additional training to students beyond operations: leadership training, communications training, and providing students the opportunity to organize conferences, etc. In addition to its impact on students and companies, the Institute has for years served as an important mechanism fueling the technology and operations faculty's relevant, problem-driven research by putting them in touch with practitioners at leading companies around the world. Since its foundation, more than 1,500 graduates have completed the program as Tauber Fellows, there have been 720 summer projects executed at 145 companies, and the Institute was honored in 2012 with the prestigious UPS George D. Smith Prize from INFORMS.

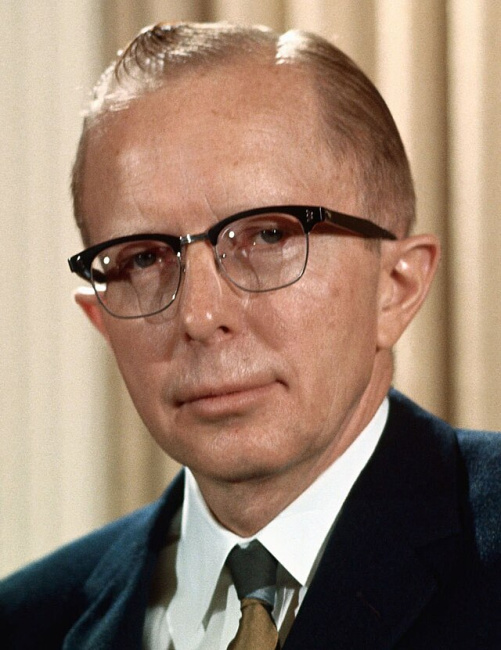

Professor Paul W. McCracken was part of the Michigan Ross faculty from 1948-1986. He was a prominent economist and adviser to both Republican and Democratic presidents and was also an advocate for an active government role in economic stabilization. McCracken advocated for government policies to moderate business cycles, control inflation, and address unemployment in order to assist the disadvantaged. As a result, McCracken played a central role in addressing the rising inflation of the late 1960s and early 1970s during his tenure as an economic adviser to President Richard Nixon. McCracken criticized the government for not taking sufficient measures to combat inflation, and he supported a policy of gradualism, which aimed to slow inflation by reducing economic growth slightly without causing a recession. He proposed a combination of budget surpluses and tighter monetary policy to control inflation without severely disrupting the economy. McCracken was present during the decision to unilaterally end the Bretton Woods system, which had fixed exchange rates for major currencies. This decision resulted in far-reaching changes in the international monetary system.

Professor Jim Walsh played a significant role in the development of work on individual, group, and collective cognition in organizations. Interested in managerial mistakes, Walsh wanted to know if executives’ worldviews could blind them to their decision environments. He was also interested in learning how the cognitive capabilities of both leadership teams and the organization itself could be harnessed for the good of organizations. In a 1988 Academy of Management Journal article, Walsh traced how these belief structures might or might not blind executives to their decision environments. He also considered how these belief structures may or may not combine to shape team decision-making. Therefore, he wrote a theoretical paper about these possibilities, which was published in the Journal of Management in 1986. He followed up that article with an empirical effort to measure and trace the impact of “negotiated belief structures” on decision-making (Organizational Behavior and Human Decision Processes published his findings in 1988). His thoughts then turned to the organization as a whole. He wrote a seminal paper on organizational memory, one that identified the nature of information selection, retention, and retrieval processes in organizations – for the good or ill of those organizations. That work was published in the Academy of Management Review in 1991. When interest in cognition in organizations started to grow, Walsh became a founding officer of the Academy of Management’s Managerial and Organizational Cognition Interest Group in 1990 and helped to lead that pioneering group of scholars for the first three years of its existence. Tying all of the insights and experiences together, he wrote what became something of a field-defining scholarly paper in 1995. Titled “Managerial Organizational Cognition: Notes from a Trip Down Memory Lane,” it was published in Organization Science. Today the Managerial and Organizational Cognition Division of the Academy of Management is home to more than 1,200 scholars worldwide. Citing his foundational scholarship and early leadership, the Division honored Jim with its Distinguished Scholar Award in 2020.

Previously, it was commonly believed that the media had little role to play in capital markets -- that they neither produced information nor disseminated information in a meaningful manner. Professor Greg Miller questioned this logic and set out to see if there was empirical evidence that would support such an assumption.

Miller found that the business press acted as a corporate watchdog that was instrumental in uncovering financial misconduct. As such, the business press was no longer viewed as talking heads, but as investigative journalism which brought value to the market through the governance role it played. With the more recent introduction of social media, many believed that social media had no role to play in capital markets. A team of researchers from U-M, including Beth Blankespor, Miller, and Hal White, decided to take a novel approach and see if social media could improve capital market outcomes.

Their work was the first to show that social media played an important role in disseminating corporate financial information. Their foundation of research was instrumental in corporate investor relation groups adopting social media to disseminate information to market participants.

In her research published in the American Economic Review, the Review of Economics and Statistics, the Journal of Human Resources, Health Affairs, and other outlets, Professor Sarah Miller has used quasi-experimental methods to evaluate whether receiving improved access to health care in utero, in early childhood, and throughout childhood improves outcomes in adulthood. Miller and her co-authors have found that children who have received eligibility for health insurance through the Medicaid program have improved outcomes on a number of dimensions, both in terms of health and economic outcomes. Additionally, they found that the children of those children who had better access to healthcare in childhood were healthier at birth. This suggests a cycle in which investing in children's health today can have multigenerational benefits that allow the government to fully recoup the cost of its initial investment in the form of higher tax payments and lower spending on welfare programs. Miller's research has been discussed in numerous high-profile news outlets and has strongly impacted how academics and policymakers view investments in children. Furthermore, her papers have been cited nearly 500 times.

In the early 2000s, Professors Tim Fort and Cindy Schipani held the first conference on the role of business in promoting peace. The conference was attended by former Secretary of State Madeline Albright and brought together individuals from academia, business, and government to discuss efforts that could be made to reduce violence in the world. It was concluded that there is a role of business, especially in serving as an unofficial ambassador or role model when conducting business internationally. This event set in motion the beginnings of a new research paradigm on "Peace Through Commerce."

The 1996 book Competing for the Future by the late Professor C.K. Prahalad and his colleague, Gary Hamel from the London Business School, was unique in that it tied together several of Hamel and Prahalad's leading ideas into book format. The book introduces the concept of "core competencies," which emphasizes that organizations should focus on leveraging their inherent strengths and unique capabilities, and "strategic intent," which focuses on setting an ambitious, long-run vision for a firm's future. This emphasis on future thinking was a particularly notable aspect of the book. In general, the book advocated for a proactive approach to strategy where businesses actively envision and shape the trajectory of their respective industries instead of merely reacting to existing competitors and market dynamics in the short run. This emphasis on dynamics -- in particular, envisioning the future and then mobilizing strategy to compete in shaping it -- had important managerial implications for business thinking in the 1990s. It suggested that companies needed to transition from a short-term, reactive mindset to a more forward-thinking, visionary stance; this would allow companies not just to survive but dominate in future market landscapes. Overall, this book had a notable impact on business practice; Time Magazine named it one of "The 25 Most Influential Business Management Books."

In the early 1990s, Professor Garry Brewer became dean of the U-M School of Natural Resources and the Environment. He approached Dean Joe White of the Michigan Business School with the concept of a dual-degree program to prepare future business leaders with an integrated education in both earth and management sciences. The concept took shape first in 1993 in the form of a graduate dual-degree program (originally called the Corporate Environmental Management Program) under the leadership of Professor Stuart Hart and then the Erb Institute after a generous grant from Fred and Barbara Erb in 1996 and a series of additional donations from other visionary donors. The dual-degree program was then incorporated into the Erb Institute and bolstered by the scholarly research of three newly endowed professorships. Nearly 30 years later, the Erb Institute has expanded dramatically to become a full-fledged, endowed institute with three chaired professors, an undergraduate Erb Fellows Program, more than 200 graduate and undergraduate students, and more than 750 alumni across 17 countries. In addition, the institute has an active agenda of scholarly and applied research and works to facilitate business engagement through business roundtables and global conference partnerships. Today, the Erb Institute is generally recognized as the leading business sustainability institute for research, teaching, and business engagement.

The original trading floor at the Michigan Business School was established in 1999. At the time, it was the 12th academic trading lab to be developed in the United States and one of the first in a large public university.

Later, with a generous donation by John and Georgene Tozzi, a new lab was built. Over the years, thousands of students have come through the lab.

Today, there are approximately a dozen investment clubs, seven of which meet weekly in the lab. When the lab was first getting started, the student-managed fund was at $95,000, which has since grown to $700,000.

Professor Charles Laselle Jamison, a pioneering figure in the sphere of business management, spent most of his career at the Michigan Business School. Recognizing the importance of the evolving field of management education in 1936, Jamison proposed an organization dedicated to the support of high-quality research, teaching, and practice in the field. His vision led to the official launch of the Academy of Management in 1941. For this instrumental role, he became known as the "Father of the Academy of Management." With the onset of World War II, the Academy's operations were put on hold. However, they were revived in 1947 thanks to Jamison's tireless commitment. Since then, the Academy of Management has become an internationally recognized association for management and organization scholars.

Later in his career, Jamison would cement his legacy as a pioneer in the field of strategic management by publishing his 1953 textbook on business policy. The textbook was one of the first on the subject and showcased his invaluable contribution to the field.

William Davidson (1922-2009) was a successful global business leader and alum of the University of Michigan. He understood the value of the private sector to empower people around the world.

After the fall of the Berlin Wall, Davidson recognized the value of educating and empowering economic decision-makers in formerly centralized economies with the tools of commercial success. Davidson partnered with U-M to create a unique institute providing consulting and training services to nonprofits, corporations and small businesses in emerging markets with the goals of economic growth and social progress. Since 1992, the William Davidson Institute (WDI) has served as a platform to introduce students to the challenges and opportunities facing firms in low- and middle-income countries.

Over its history, the Institute has supported U-M student teams, totaling more than 1,800 students, who collaborate with business and nonprofit partners to provide analysis and develop solutions built upon the foundation of basic business principles. To ensure ongoing access to current and relevant business education, WDI Publishing also produces and distributes high-quality, cutting-edge business cases and other teaching materials, with more than 700 cases in its collection, reaching approximately 800 universities and institutions globally.

The Institute is also home to NextBillion.net, an online platform for discussing business models and innovations that address development challenges in low- and middle-income countries. The platform reaches more than 25,000 readers a month.

Sensory marketing is a relatively new and growing field of marketing that Professor Aradhna Krishna pioneered in the early 2000s. Krishna saw that there were disparate fields of study on senses, but there was no cohesion between these fields. She brought all these sub-fields together under the umbrella of sensory marketing and organized the first conference on it in 2008. She then wrote two books and dozens of scholarly articles on the subject to make the field grow. And the field did grow both in academia and in practice -- enough for Harvard Business Review to do a lead Ideawatch article on it featuring Krishna as the world's foremost expert on the topic. Krishna has defined "sensory marketing" as marketing that engages the consumers' senses and affects their perception, judgment, and behavior. Krishna continues to publish important, scholarly articles on the topic. She also started the Sensory Marketing Lab at Michigan Ross, which attracts PhD students and post-docs from around the world.

Professor Gautam Kaul and two former PhD students, in their seminal 1994 study titled, "Transactions, Volume, and Volatility" convincingly argued and verified empirically that it is the occurrence of a trade in a certain direction rather than its dollar value (or volume) that has the greatest effect on prices, hence the greatest relevance when assessing the liquidity of the market where that trade took place. A trade sign is determined by the buyer or seller's information, while market conditions determine trade amount and price. This is a simple yet extremely powerful notion that was originally predicated in theory but had no empirical support before their 1994 study. The publication of this study opened the door to the accurate measurement and needed assessment of market liquidity. These days, the approach they recommended is widespread in its use.

Management and Organizations professors Sue Ashford and Jane Dutton invented the concept of "issue selling," arguing that most middle managers don’t simply wait for the organization’s strategy to come down from on high but also actively try to influence what that strategy might be. These active middle managers recognize that organizations have limited attentional capacity, and they try to influence what issues get on the organization’s agenda and gain the attention of top decision-makers for issues such as the need to be more ecologically sensitive, the experiences of gender mistreatment and other social issues. In other words, whereas the literature to that point had construed middle managers as passive recipients, these scholars gave them agency and engaged in several studies to better understand how they use that agency to affect bottom-up change. The impact of this idea can be seen in both the popularity of the advice given to middle managers derived from it and in its anticipation of the larger literature on social movements. Social movements were first studied outside of organizations in society, but scholars later proposed that such movements could also occur within organizations, as in issue selling.

The paper "CONWIP: a pull alternative to kanban" by Professor Wally Hopp and coauthors, published in The International Journal of Production Research in 1990, presents an innovative production control method known as Constant Work-In-Process. CONWIP represents a notable advance over the well-known Kanban approach of the Toyota Production System that outperforms Kanban under a wide range of settings, is more adaptable to variability, and, unlike Kanban, is suited to environments with a large number of products. The path-breaking analysis of this paper spurred a significant stream of research into the performance of pull production systems that continues to this day. CONWIP has also become a standard part of the operations lexicon and has seen widespread application in industrial settings. Finally, CONWIP was an essential building block of the science of manufacturing that Wally and others introduced as Factory Physics in subsequent work.