Explore the faculty research, thought leadership, and groundbreaking philosophies that established Michigan Ross as one of the world’s top business schools.

In 1991, Dean Joe White and Associate Dean Paul Danos introduced the groundbreaking Multidisciplinary Action Projects course to the MBA curriculum. The initial full-time, seven-week project established a team of MBA students to work on a real-world business challenge for a sponsor company. After a pilot run, the course became part of the MBA core curriculum in 1993. In the coming years, MAP would be added to other MBA programs and eventually to most of the school’s degree programs.

Since its inception, many other schools have incorporated project-based opportunities into their degree programs. However, Michigan Ross remains the leader in the space, and MAP has stood as a beacon of innovation and impact within the realm of graduate studies. What has truly set the MAP program apart is its unwavering commitment to bridging the gap between theory and practice. Instead of confining students to lecture halls, the program enables students to venture into the field, partnering with corporations, nonprofits, and startups to address genuine business challenges and exposing students to the intricacies of various industries while cultivating their ability to think critically, adapt swiftly, and communicate effectively.

Over the years, more than 3,200 MAP projects have been completed by Michigan Ross students. Today, more than 1,000 students participate annually in a MAP project as a required component of their degree program. The organizations they work with range from Fortune 100 multinational corporations to start-ups and non-profits, developing impactful products and addressing some of society's biggest challenges.

In 2006, Professor Sue Ashford, associate dean for leadership programming, founded the Ross Leadership Initiative, which was the precursor to the Sanger Leadership Center and one of the first organized leadership programs among business schools worldwide. The initiative was influenced by Ashford's research on learning leadership via experience and Professor Noel Tichy's action-based learning concepts. Suddenly students were not just learning about leadership but were actually engaged in doing it. Prominent among these efforts was the highly influential Leadership Crisis Challenge, which puts students in the hot seat needing to resolve a crisis in the moment. This program was recognized with the Provost's Teaching Innovation Prize in 2011 and remains a prominent and popular program in the school to this day. Later, under the leadership of Professors Scott DeRue and Gretchen Spreitzer, RLI grew and launched new programs that persist today, including Story Lab, the Ross Leaders Academy, and more. In 2015, alum Stephen W. Sanger, MBA '70, and Karen Sanger made a defining gift of $20 million to establish the Sanger Leadership Center. With the Sangers' gift, the Sanger Leadership Center, now under the leadership of Professor Lindy Greer, has created an array of custom programs and workshops and now offers leadership development programs for students across the university.

Professor Karl Weick was an iconic founder of the field of organizational behavior. Starting with his seminal book, The Social Psychology of Organizing, which was published in 1969, Weick's ideas had enormous influence, shaping organizational scholarship over the next decades and to this day. He focused on the processes of organizing rather than on organizations per se, suggesting that the insights into those processes give us important leverage to both understand and affect life in organizations. In his book, he introduced the seminal concept of "sense-making," which he defined as "the ongoing retrospective development of plausible images that rationalize what people are doing." Weick's ongoing research focused on how individuals engaged in making meaning and how that meaning-making affected important outcomes in organizations. His book has been cited more than 35,000 times, and his other work on the topic has been cited more than 13,000 times. His pioneering work has instilled a highly influential perspective on the people attempting the organizing work that goes into organizations.

Professor David Brophy brought the study of small businesses and private financial markets (now known as alternative, in contrast to publicly traded markets) to Michigan Ross and the state of Michigan before it was recognized as a legitimate area of study at top research universities. This process started in the mid-to-late seventies, and Brophy relentlessly created awareness in Michigan and educated students interested in this space. For over fifty decades, until his recent retirement, Brophy designed and taught all Michigan Ross venture capital and private equity courses.

"Co-creation as a revolutionary paradigm was introduced by Professors C. K. Prahalad and Venkat Ramaswamy in a series of articles published between 2000 and 2004 and an award-winning book, The Future of Competition. Their work provided a new frame of reference for jointly creating value through networked environments of increasingly digitalized experiences, going beyond goods and services, and called for a process of co-creation -- the practice of developing offerings, experiences, and unique value through ongoing interactions with customers, employees, managers, financiers, suppliers, partners, and other stakeholders. Through their work, they envisioned an individual and experience-centric view of interactive value creation and innovation.

Starting in 2005, the explosion of digital and social media, the convergence of technologies and industries, embedded intelligence, and information technology-enabled services enabled enterprises to build platforms for large-scale, ongoing interactions among the firm, its customers, and its extended network. Ramaswamy's work argued that success lies in connecting with people's experiences to generate insights and change the nature and quality of interactions. He also called for co-creation from the inside out of enterprises and their networks, as much as co-creation from the outside in, and for leaders to co-create transformative pathways.

In 2014, Ramaswamy published "The Co-Creation Paradigm", which combined the core ideas of co-creation with a call to see, think, and act differently in an interconnected world of possibilities and complex challenges to co-create a better future as individuals."

In 2021, Assistant Professor Andreas Hagemann developed a new econometric methodology that addresses the complexities of clustered data to enhance the accuracy and reliability of empirical work in economics and related fields. Typical examples of clusters are firms, cities, or states. The central challenge is that units within clusters may influence one another or may be influenced by similar environmental factors in ways that cannot be observed. Empirical researchers know that neglecting to account for clusters can yield results where non-existent effects erroneously appear as highly significant. Hagemann's research agenda developed new tools to address this issue in challenging and empirically relevant scenarios. His work has had a substantial impact on econometric theory and empirical practice. For instance, the methodology he developed is now the standard option for clustering in the canonical implementation of quantile regression in the statistical programming language R.

The Preparation Initiative was created by Professor Emeritus Frank Yates in 2005. Yates was a champion of diversity in higher education and believed all students should have access to Michigan Ross, regardless of their preparation. The Preparation Initiative is a thriving community designed to foster the excellence and success of undergraduate business students from economically distressed backgrounds or from racial or ethnic groups historically underrepresented in business leadership. Since its inception, the Preparation Initiative has supported hundreds of students in their pursuit of a business education and now also offers mentoring opportunities for alums of the program.

In 1998, Professor David Hirshleifer of the Michigan Business School, and two co-authors, published a paper titled "Investor Psychology and Security Market Under- and Overreactions." This paper has been widely recognized as the first explanation of the seemingly contradictory behavior in asset prices (under- and overreactions to different news) based on two well documented behavioral biases. The biases outlined in the paper are overconfidence (regarding the precision of one's private information) and biased self-attribution. The former leads to well documented evidence of long-term overreaction (price reversals), while the latter causes underreaction (momentum) in the medium term. This paper was the first widely recognized paper in finance based on departures from rational behavior and provided a compelling explanation for seemingly anomalous behavior in asset prices.

The Michigan Business Challenge is a prestigious business plan competition hosted by the Zell Lurie Institute for Entrepreneurial Studies. It allows U-M students to showcase their entrepreneurial ideas, receive feedback from experienced judges, and compete for over $100,000 in cash prizes to support their ventures.

The Michigan Business Challenge was established in 1984 at Michigan Ross and has since become one of the region's most impactful and well-known startup competitions. Over the years, the MBC has supported numerous successful startups, generated millions of dollars in funding, and helped launch successful entrepreneurial careers for U-M students and alumni. The MBC is open to various stages of business concepts, from early-stage ideas to established businesses.

The competition consists of three tracks that cater to specific industry sectors, including the Seigle Impact Track for social ventures, the Invention Track for ventures that have intellectual property at the core of their high-tech venture, and the Innovation Track for growing startups. These tracks provide tailored resources, networking opportunities, and funding for participants. Notable entrepreneurial ventures that have come through the MBC include Morning Brew, Xoran Technologies, AMBIQ Micro, Elevate K-12, and many more.

The root of the Great Financial Crisis of 2008-2009 lay in poor-quality residential mortgage loans made by financial institutions. A set of academic research papers established that lenders made poorer quality loans when they anticipated selling the loans to investors rather than continuing to own the loans until they matured. When loans were sold, a complex securitization process led to a large distance between the originator of a mortgage and the final investor in the loans. Amit Seru, PhD '07, and co-authors established in an important series of papers that focused on 1) keeping most characteristics of loans the same, loans that were only marginally easier to securitize had significantly higher default rates than those that were marginally more difficult to securitize, 2) (in work with Professor Uday Rajan) securitized loans, the interest rate (which represents the compensation to investors for bearing the risk of default by the borrower) became an increasingly worse predictor of default in the build-up to the GFC, and 3) information passed on to investors by mortgage securitizers was limited and sometimes outright fraudulent. In another crucial strand of work, Professor Amiyatosh Purnanandam demonstrated that 1) loans held by banks on their own balance sheets had lower default rates than otherwise identical loans sold by banks to investors and 2) (in work with Taylor Begley, PhD '14, and Kuncheng Zheng, PhD '15) even with securitized loans, default rates were lower when the riskiest tranche was held by the lender rather than sold to investors. Collectively, the work done by Ross faculty and PhD alums showed that the ability to securitize mortgage loans undermined the incentives of lenders to the point that low-quality mortgage loans were made, essentially providing the dry timber that fueled the GFC.

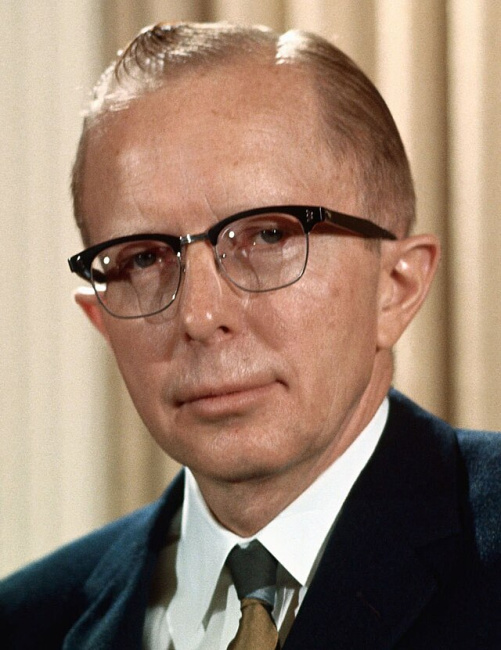

Professor Paul W. McCracken was part of the Michigan Ross faculty from 1948-1986. He was a prominent economist and adviser to both Republican and Democratic presidents and was also an advocate for an active government role in economic stabilization. McCracken advocated for government policies to moderate business cycles, control inflation, and address unemployment in order to assist the disadvantaged. As a result, McCracken played a central role in addressing the rising inflation of the late 1960s and early 1970s during his tenure as an economic adviser to President Richard Nixon. McCracken criticized the government for not taking sufficient measures to combat inflation, and he supported a policy of gradualism, which aimed to slow inflation by reducing economic growth slightly without causing a recession. He proposed a combination of budget surpluses and tighter monetary policy to control inflation without severely disrupting the economy. McCracken was present during the decision to unilaterally end the Bretton Woods system, which had fixed exchange rates for major currencies. This decision resulted in far-reaching changes in the international monetary system.

In 1999, former Michigan Ross finance faculty member Josh Coval co-authored a paper that is among the top 50 most-cited papers in finance. The paper shows one of the most intriguing patterns in individual behavior. The strong bias in favor of domestic securities is a well-documented characteristic of international investment portfolios, yet this paper shows that the preference for investing close to home also applies to portfolios of domestic stocks. Specifically, U.S. investment managers strongly prefer locally headquartered firms, particularly small, highly leveraged firms that produce nontraded goods. These results suggest that asymmetric information between local and non-local investors may drive the preference for geographically proximate investments, and the relation between investment proximity and firm size and leverage may shed light on several well-documented asset pricing anomalies.

Currently organized by the Sanger Leadership Center, the Leadership Crisis Challenge partly came about based on Sue Ashford’s vision as the then head of the Ross Leadership Initiative and the enthusiasm of students wanting to create more venues to discuss complex and problematic business issues, such as the role of business in addressing society's most difficult problems and how businesses and other leaders might think about tensions between financial and environmental goals. Additionally, there was an interest in understanding how students, as future leaders, might best think about issues of corporate social responsibility. The LCC was intended to address those student interests by putting students in groups of four and asking them to exercise their courage, judgment, and integrity in response to a complex crisis situation and under strict time pressure. In the crisis challenge, students are confronted with a complex case for which there is no right answer or winning position – there are just tradeoffs. Built into the case are some of the most vexing questions of the day, including: What does a company “owe” the community in which it does business? Should the natural environment be sacrificed for shareholder wealth? Can companies admit wrongs in today’s aggressive legal climate? With the input of previous participants, the Net Impact club, and members of the faculty, a new case is prepared every year and overseen and judged by Michigan Ross community members, business leaders, and alums.

Since the COVID-19 pandemic, the public K-12 education system has faced significantly high teacher turnover and poor retention rates. Teachers have faced increasing pressure to achieve academic success while challenged with growing class sizes, reduced funding, and learning loss from the pandemic. This problem has been incredibly difficult to correct, and public school districts across the country have not been able to address it cost effectively.

In their paper, “Stopping the Revolving Door: An Empirical and Textual Study of Crowdfunding and Teacher Turnover,” Professors Samantha Keppler, Jun Li, and Andrew Wu conducted a study of data from the largest teacher crowdfunding site, DonorsChoose, to study the effect of crowdfunded projects on teacher retention. The team found that teachers are less likely to leave their schools and the state public school system when their projects are funded. Assessing teachers’ project request essays, they identified that teachers who received funding for unique projects or requested resources to improve their classroom environment had higher retention rates.

Their paper is the first to identify the effect of crowdfunding on teacher retention. It provides initial, strong evidence that the effect is positive, showing that teachers funded on DonorsChoose are 1.6 percentage points (pp) less likely to leave their schools and 1.9 pp less likely to leave the teaching profession — a 14% and 41% reduction versus baseline turnover and attrition rates, respectively.

Due to the demonstrated impact of teacher-driven crowdfunded projects, DonorsChoose has partnered with eight states to spend COVID-19 education relief funding on teacher crowdfunding projects. To date, these partnerships have funded over $100 million of teacher projects from over 100,000 teachers, impacting over 10 million students.

In the book Build, Borrow, or Buy: Solving the Growth Dilemma the late Professor Will Mitchell and his co-author Laurence Capron developed a groundbreaking framework showing how firms can dynamically manage their resource portfolios and choose an appropriate growth strategy in turbulent market environments fraught with institutional, technological, and economic challenges. This comprehensive framework integrates the capability-based perspective with the principles of transaction cost economics. The intellectual origins of the capability-based perspective are deeply rooted in the foundational work in the strategy field carried out at the University of Michigan around 1980. Mitchell's foundational framework has not only shaped the research agendas of scholars interested in central questions in corporate strategy but also influenced practitioners who are faced with the perpetual strategic conundrum of how best to grow their firms.

The paper "Value of Information in Capacitated Supply Chains" by Professor Roman Kapuscinski and his co-authors was published in Management Science in 1999. This paper contributed significantly to the understanding of how information sharing impacts the performance of supply chains. Specifically, this paper turned on its head the notion that information would be most valuable in settings where capacity is tight, when the uncertainty of demand is huge, and when the costs of unsatisfying demand are very high. The paper uses careful, rigorous analyses to reveal when information is most valuable and how the value depends on many interrelated factors. Providing an innovative analytical model, Kapuscinski and his colleagues demonstrated when and how the sharing of demand information could remarkably enhance inventory management and order fulfillment for capacity-constrained supply chains. The subsequent literature in operations management has heavily referenced this pioneering work, leading to the development of practical strategies for improving supply chain efficiency through information sharing. Further studies have explored different facets of information sharing in diverse supply chain settings and have considered more complex forms of information, extending the paper's impact in many directions within operations.