Explore the faculty research, thought leadership, and groundbreaking philosophies that established Michigan Ross as one of the world’s top business schools.

The fields of social movements and organizations had very little overlap until Professors Jerry Davis and Mayer Zald convened a pair of conferences at Michigan Ross in 2001 and 2002 that brought together top scholars from both domains and forged research collaborations that yielded a 2005 Cambridge University Press volume and a 2008 special issue of Administrative Science Quarterly. Zald had previously published a piece on the topic in 1977, as had Davis in 1994. Today, this is a widely recognized and fruitful research domain that arose just in time to explain the increasingly prevalent interplay between corporations and social movements, including boycotts, corporate political activism, and employee social movements.

”Bifurcation of the Owner and Operator Analysis" was published by Professor Lynda Oswald in 1994. Her research was cited and quoted extensively by the U.S. Supreme Court in its unanimous decision in United States v. Bestfoods (1998) in clarifying parent corporations' direct and indirect liability for their subsidiaries’ actions in the context of CERCLA liability and hazardous waste cleanup. The liability of a parent corporation for the acts of the subsidiary is a complex issue that permeates all areas of corporate law and business relationships, and is not confined to the environmental context found in Bestfoods. Oswald’s research has since informed the decisions of over 55 additional courts -- federal trial and appellate courts as well as state appellate and supreme courts -- in business law contexts as varied as environmental liability, whistle-blowing under the Sarbanes-Oxley Act, the Racketeering-Influenced Corrupt Practices Act (RICO), employment discrimination, medical malpractice, negligence, bankruptcy, and real estate transactions.

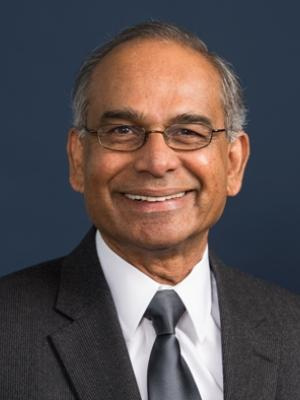

In 1985, Professor M.P. Narayanan published a paper on managers' proclivity to focus on the short- rather than the long-term. His paper is a rigorous and theoretical explanation that requires the manager to have private information. Narayanan shows that the manager's proclivity to focus on the short-term is more evident in a less experienced manager but is attenuated if the business's riskiness and the contract's length increase. While singling out the importance of the short- and long-term conflict as the basis for the myopic behavior of firms may be a challenge, this phenomenon is ever-present.

The late 1990s ushered in a revolutionary view across the social sciences centered around the power and importance of studying strengths, better understanding how people thrive, and how systems seize opportunities for creating excellence. Michigan Ross led the way in advancing this fundamental research shift in the field of management and organizations, with many scholars publishing seminal research in the field. In 2002, three faculty members, Jane Dutton, Bob Quinn, and Kim Cameron, founded the Center for Positive Organizations to encourage rigor in this growing field of research and to serve as a home for a large network of scholars interested in pursuing this line of inquiry. As the field has grown over the years, Positive Organizational Scholarship has influenced how management is taught and practiced. CPO at Michigan Ross is a leader in helping teachers and students tap into this body of evidence and learn about this research through innovative courses and developmental learning programs. Those tools include the "Reciprocity Ring", a dynamic group exercise that applies the “pay-it-forward” principle while creating high-quality connections, and the "Reflected Best Self Exercise", which helps you see who you are at your best to engage you to live and work from that powerful place daily.

Beginning from seminal efforts by Brian Talbot at the Michigan Business School in the early 1990s, the Tauber Institute for Global Operations was designed to bring business and engineering students together for a world-class education in operations. Students would take classes in both business and engineering and complete team projects with companies. The projects were scoped to incorporate both business and engineering content, addressing important problems that had a VP-level champion at the sponsoring company. The institute was innovative by offering additional training to students beyond operations: leadership training, communications training, and providing students the opportunity to organize conferences, etc. In addition to its impact on students and companies, the Institute has for years served as an important mechanism fueling the technology and operations faculty's relevant, problem-driven research by putting them in touch with practitioners at leading companies around the world. Since its foundation, more than 1,500 graduates have completed the program as Tauber Fellows, there have been 720 summer projects executed at 145 companies, and the Institute was honored in 2012 with the prestigious UPS George D. Smith Prize from INFORMS.

In 1984, former faculty member Birger Wernerfelt introduced a paradigm shift in business strategy with his paper "A Resource-Based View of the Firm." Prior to this transformative work, the discourse on business strategy was predominantly centered around external market factors and competitive forces.

Wernerfelt challenged this conventional wisdom by presenting the argument that a firm's internal resources, ranging from tangible assets like machinery to intangible assets like reputation, could be the key to creating a competitive advantage. This theory, known as the Resource-Based View, asserts that for resources to offer a firm sustained competitive advantage, they must be valuable, rare, and difficult to substitute or imitate.

The RBV has had profound implications and has changed how firms undertake strategic planning by emphasizing the importance of leveraging internal assets for competitive advantage. Wernerfelt's paper has been cited in thousands of academic publications and is now a staple in business school curricula worldwide.

The marketing faculty at the University of Michigan has, over the decades, made several foundational contributions to the area of consumer behavior. Professor Joseph W. Newman, who was a marketing faculty member at the Michigan Business School from 1949-51 and again from 1965-73, helped greatly through his books and research publications to deepen the impact on the marketing discipline of concepts including economics and decision theory, psychology, sociology, and anthropology, especially through the qualitative research techniques of motivational research. Along with his doctoral students, he published highly impactful research on how consumers gather and use pre-purchase information. He also published research on customer satisfaction and dissatisfaction. For these and other contributions, he was named a fellow of the Association of Consumer Research in 1990, its highest honor. In the decades since, the marketing faculty at Michigan Ross has continued to make many more notable contributions to our understanding of consumer behavior.

In a paper published as a lead article in the Journal of Finance in 1990, Professor Nejat Seyhun investigated whether informed investors stabilize and correct mistakes in security prices by buying undervalued assets and selling overvalued assets or destabilize security prices by jumping into already overpriced securities to create bigger bubbles and mis-valuations first, only to exploit them later. Seyhun's investigation centered on the stock market crash of Oct. 19, 1987, when the stock market crashed by 22% in one day. He found that top corporate insiders bought undervalued stocks and sold overvalued stocks in record quantities immediately following the crash. Hence, informed insiders were stabilizing security prices and not destabilizing them further. This finding provides comfort that the stock market will be self-policing and self-correcting and justifies the current regulatory system, which assumes that more information is beneficial by requiring timely, accurate, and full dissemination of information from all parties involved. Seyhun was among the first to explore various aspects of reported insider trading and its effects on share prices and shareholder wealth.

Four student-run venture funds are currently operating at Michigan Ross, more than any other business school. Collectively, these funds manage a portfolio worth more than $10 million. These funds help students learn about investing early-stage capital by making real deals with real companies and real money. The concept of student-run venture funds has been adopted by universities around the world.

Since an article she published in the Iowa Law Review in 1995, Professor Dana Muir has worked in the field of fiduciary obligation, particularly as it relates to the investment of the almost $37 trillion in U.S. retirement assets, but also as it relates to a variety of other employee benefit plans. In her 1995 article, Muir explained that the courts' attempts to define fiduciary obligation using concepts from fourteenth-century trust law were misguided. Muir has subsequently addressed fiduciary concepts in the context of investment advice, the extent to which employers serve as fiduciaries of the plans the sponsor, and, most recently, in their application to the consideration of environmental, societal, and governance factors in the investment of retirement fund assets.

"Co-creation as a revolutionary paradigm was introduced by Professors C. K. Prahalad and Venkat Ramaswamy in a series of articles published between 2000 and 2004 and an award-winning book, The Future of Competition. Their work provided a new frame of reference for jointly creating value through networked environments of increasingly digitalized experiences, going beyond goods and services, and called for a process of co-creation -- the practice of developing offerings, experiences, and unique value through ongoing interactions with customers, employees, managers, financiers, suppliers, partners, and other stakeholders. Through their work, they envisioned an individual and experience-centric view of interactive value creation and innovation.

Starting in 2005, the explosion of digital and social media, the convergence of technologies and industries, embedded intelligence, and information technology-enabled services enabled enterprises to build platforms for large-scale, ongoing interactions among the firm, its customers, and its extended network. Ramaswamy's work argued that success lies in connecting with people's experiences to generate insights and change the nature and quality of interactions. He also called for co-creation from the inside out of enterprises and their networks, as much as co-creation from the outside in, and for leaders to co-create transformative pathways.

In 2014, Ramaswamy published "The Co-Creation Paradigm", which combined the core ideas of co-creation with a call to see, think, and act differently in an interconnected world of possibilities and complex challenges to co-create a better future as individuals."

Franchised chains have an outsize influence on the economy: firms involved in a variety of business activities are organized as franchised chains and they employed over 9.6 million workers in the United States in 2017 according to the Census Bureau. Professor Francine Lafontaine's pioneering work on franchising shows that the success of this organizational form across various sectors results from the franchisor and franchisee specializing in the activities they are best suited to. Specifically, the franchisor specializes in creating and supporting the business format and brand, where scale is especially beneficial, and the franchisee optimizes operations locally, where their knowledge and efforts are particularly valuable. Lafontaine's work in this area has informed the choices that franchisors make and the nature of the contracts they use, and also the debate over legislation that aims to address the alleged shortcomings of the franchising organizational form.

Her work suggests caution in developing potential public policy changes as consumers, existing and potential franchisees, as well as their employees stand to lose in the long term if franchising becomes less competitive as a form of organization. More broadly, Lafontaine's research has made seminal contributions to our understanding of how firms interact with each other in the process of procuring inputs or distributing their products, and prompted her appointment as Director of the Bureau of Economics at the FTC in 2014-15. In particular, her research has shown that factors driving vertical integration and vertical contracting can be very different from those motivating horizontal mergers, so analyses of vertical mergers should start from a different premise compared to analyses of horizontal mergers. Her detailed analyses of franchise contract terms, as described in her book The Economics of Franchising, provide further reasons why, in her view, the rule of reason continues to be the right approach in antitrust cases involving vertical restraints.

William Davidson (1922-2009) was a successful global business leader and alum of the University of Michigan. He understood the value of the private sector to empower people around the world.

After the fall of the Berlin Wall, Davidson recognized the value of educating and empowering economic decision-makers in formerly centralized economies with the tools of commercial success. Davidson partnered with U-M to create a unique institute providing consulting and training services to nonprofits, corporations and small businesses in emerging markets with the goals of economic growth and social progress. Since 1992, the William Davidson Institute (WDI) has served as a platform to introduce students to the challenges and opportunities facing firms in low- and middle-income countries.

Over its history, the Institute has supported U-M student teams, totaling more than 1,800 students, who collaborate with business and nonprofit partners to provide analysis and develop solutions built upon the foundation of basic business principles. To ensure ongoing access to current and relevant business education, WDI Publishing also produces and distributes high-quality, cutting-edge business cases and other teaching materials, with more than 700 cases in its collection, reaching approximately 800 universities and institutions globally.

The Institute is also home to NextBillion.net, an online platform for discussing business models and innovations that address development challenges in low- and middle-income countries. The platform reaches more than 25,000 readers a month.