Explore the faculty research, thought leadership, and groundbreaking philosophies that established Michigan Ross as one of the world’s top business schools.

Launched in 2014 by Michigan Ross and the Zell Lurie Institute for Entrepreneurial Studies, the Desai Accelerator is dedicated to advancing U-M alumni entrepreneurial ventures. The Accelerator provides the physical infrastructure, financial resources, and mentorship to support alumni startups as they reach the critical phase between early-stage development and the point at which they seek external investors.

At Desai Accelerator, startups can access a wide network of experienced advisors, including entrepreneurial mentors, industry experts, venture capitalists, angel investors, and other business leaders. To engage students, Desai offers internships for undergraduates and graduates from all U-M schools and colleges. The Desai Accelerator program runs an annual cohort that supports passionate entrepreneurs as they advance their early-stage ventures. Startups accepted into the program receive funding, tailored mentorship opportunities, national visibility, and other resources to support their success.

The Desai Accelerator has invested more than $1 million in 44 startup ventures on behalf of the University of Michigan and has engaged 75+ student interns. Funding and support for the Accelerator are provided by the Desai Sethi Family Foundation, the William Davidson Foundation, and the Wadhams Family Foundation.

Following the decision of Dobbs v. Jackson Women's Health Organization by the U.S. Supreme Court, abortion restrictions within the United States have proliferated, and it is reasonable to expect that access to abortion services will be even further reduced in the future. The work of Associate Professor Sarah Miller investigates the impact of abortion denial using new linkages between data from the Turnaway Study and administrative records in credit reports. The Turnaway Study was a path-breaking study from the University of California San Francisco that recruited women seeking abortions, some of whom had pregnancies that just exceeded the gestational age limit of the clinic they attended and were denied abortions, others who fell just below this limit and were able to receive the abortion they sought. Miller and her co-authors found that women denied an abortion and those who received an abortion were on similar trajectories before the denial, but those denied an abortion experienced a large spike in financial problems such as unpaid bills and public records (such as bankruptcies and liens). This spike in financial problems persisted for the full six-year follow-up period that the authors had access to. The results provide evidence counter to the narrative that abortion is exclusively harmful to women who receive one (because of, for example, the regret they may feel after receiving an abortion). Instead, it suggests that giving women control over the timing of their reproduction allows them greater financial stability and self-sufficiency.

In 2002, Professor C.K. Prahalad of the Michigan Ross Business School and professor Stuart L. Hart of the University of North Carolina Kenan-Flagler Business School published the iconic article "The Fortune at the Bottom of the Pyramid" in Strategy+Business. The article suggested that "low-income markets present a prodigious opportunity for the world's wealthiest companies - to seek their fortunes and bring prosperity to the aspiring poor." Prahalad published a book with the same title five years before he passed in 2010. The article and book, with additional research and publications by Prahalad, Hart, Michigan Ross Professor Ted London, and others spawned a new business strategy for human development that has transformed into a social movement around the world known as Base of the Pyramid. The movement now includes transnationals, non-profits, social entrepreneurs, grassroots development organizations, international aid agencies, and many consulting firms dedicated to BoP strategy and implementation.

In her research published in the American Economic Review, the Review of Economics and Statistics, the Journal of Human Resources, Health Affairs, and other outlets, Professor Sarah Miller has used quasi-experimental methods to evaluate whether receiving improved access to health care in utero, in early childhood, and throughout childhood improves outcomes in adulthood. Miller and her co-authors have found that children who have received eligibility for health insurance through the Medicaid program have improved outcomes on a number of dimensions, both in terms of health and economic outcomes. Additionally, they found that the children of those children who had better access to healthcare in childhood were healthier at birth. This suggests a cycle in which investing in children's health today can have multigenerational benefits that allow the government to fully recoup the cost of its initial investment in the form of higher tax payments and lower spending on welfare programs. Miller's research has been discussed in numerous high-profile news outlets and has strongly impacted how academics and policymakers view investments in children. Furthermore, her papers have been cited nearly 500 times.

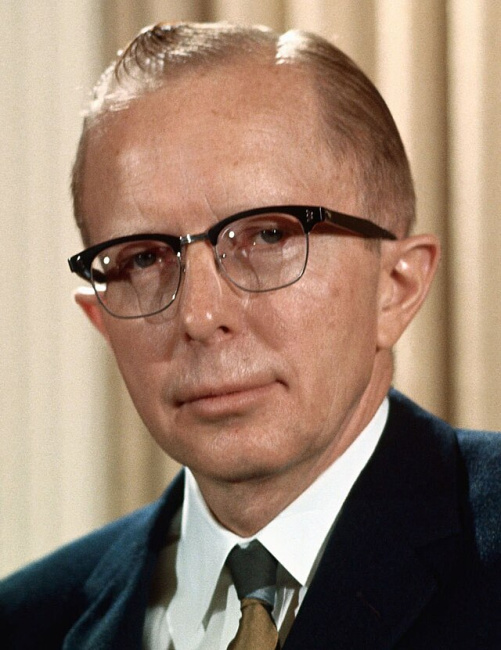

Professor Paul W. McCracken was part of the Michigan Ross faculty from 1948-1986. He was a prominent economist and adviser to both Republican and Democratic presidents and was also an advocate for an active government role in economic stabilization. McCracken advocated for government policies to moderate business cycles, control inflation, and address unemployment in order to assist the disadvantaged. As a result, McCracken played a central role in addressing the rising inflation of the late 1960s and early 1970s during his tenure as an economic adviser to President Richard Nixon. McCracken criticized the government for not taking sufficient measures to combat inflation, and he supported a policy of gradualism, which aimed to slow inflation by reducing economic growth slightly without causing a recession. He proposed a combination of budget surpluses and tighter monetary policy to control inflation without severely disrupting the economy. McCracken was present during the decision to unilaterally end the Bretton Woods system, which had fixed exchange rates for major currencies. This decision resulted in far-reaching changes in the international monetary system.

Changes in health care structure following World War II brought the need for increased legislation, regulations, and court oversight to the industry. Professor Arthur Southwick of the Michigan Business School was a leader in developing these diverse sources into a coherent framework that enabled academics, healthcare leaders, and students to understand this emerging area of law.

According to Wharton Professor Arnold Rosoff, Southwick's book, The Law of Hospital and Health Care Administration, first published in 1978, "was a central fixture in the field's literature and the means by which countless numbers of hospital administrators learned about the laws that so significantly defined their field of practice." In this way, Southwick was a thought leader in developing healthcare law. In addition to his intellectual leadership in the healthcare field, Southwick served on the State Health Planning Advisory Council in Michigan and played a key role in founding what has become the 12,500-member American Health Law Association.

Professors Norman Bishara and Jagadeesh Sivadasan have made significant contributions to influential literature examining the variation in the enforceability of non-compete clauses and their consequences. Their work is an important part of broader literature documenting monopsony power (i.e., the power of employees to set wages leading to a redistribution of surpluses away from workers), worker mobility, and knowledge transfers. In a pioneering paper published in 2010, Bishara created a detailed rating of the non-compete enforceability in all 50 states, building on painstaking work parsing the regulations and case law at the state level. The enforceability index from Bishara's 2010 paper, combined with worker-quarter-level U.S. Census data, was used in a paper by Sivadasan and co-authors to show that higher enforceability is correlated with lower wages and mobility for tech workers.

Bishara and his U-M coauthors also undertook a broad survey of U.S. workers, documenting for the first time the surprising prevalence of the use of non-compete clauses across a range of industries, including for low-wage workers, as well as work showing the chilling effect of noncompetes on employee behavior, even when they are unenforceable. This portfolio of work helped spark a major policy debate about the use and abuse of noncompetes that inspired action from the White House and the research conclusions being cited in the 2023 State of the Union Address, and spurred a report from U.S. Treasury Department, legislative changes from numerous states, and research from a range of think tanks that eventually led to the 2024 final rule from the Federal Trade Commission attempting to ban noncompetes in employment contracts across the country.

The original trading floor at the Michigan Business School was established in 1999. At the time, it was the 12th academic trading lab to be developed in the United States and one of the first in a large public university.

Later, with a generous donation by John and Georgene Tozzi, a new lab was built. Over the years, thousands of students have come through the lab.

Today, there are approximately a dozen investment clubs, seven of which meet weekly in the lab. When the lab was first getting started, the student-managed fund was at $95,000, which has since grown to $700,000.

From 2000 to 2005, Professors C.K. Prahalad and M.S. Krishnan co-authored several papers on concepts related to how the emergence of digital technologies was transforming business models. From 2005 to 2008, they co-authored the book New Age of Innovation, which introduced the concept of N=1;R=G business model framework. The basic argument was that given the new capabilities emerging from digital technologies, the structure of business models was in the midst of a transformation across industries. They claimed that business models will shift from mass production of products or services to businesses co-creating personalized experiences for one customer at a time. They called this N=1 business model, i.e., businesses will operate on a sample size (N) of one. They argued that to orchestrate this personalized experience for one customer at a time, businesses will not own all resources but will connect with resource partners across the globe (Resources=Global or R=G), and these partners could be big organizations, small businesses, entrepreneurs, or even individuals. They called this business model N=1;R=G. They argued that digital technology was at the center of enabling these capabilities, and no industry will be immune to this change. They presented more than 80 examples in the book. The rest of the book was on the capabilities companies needed to build inside their organizations to compete as an N=1 business. Their primary thesis identified the significant role of software in orchestrating the personalized N=1 experience in an ecosystem of partners and the criticality of the right capabilities in the information architecture and social architecture of companies to thrive in this competition of N=1;R=G ecosystem business models.

While concerns regarding corporate financial misreporting have persisted since the early 1900s, there were no rigorous methods that academics, market participants, and regulators could use to assess the accounting quality or the potential for financial misreporting when looking at a set of financial statements. Faculty members Patricia Dechow, Ilia Dichev, and several of their co-authors in the Michigan Accounting group developed several widely used models that allow users to assess the financial reporting quality of a set of financial statements and, more importantly, allow users to detect potential earnings management. These models and adaptations of these models continue to be used today, both in research and in accounting courses.

Four student-run venture funds are currently operating at Michigan Ross, more than any other business school. Collectively, these funds manage a portfolio worth more than $10 million. These funds help students learn about investing early-stage capital by making real deals with real companies and real money. The concept of student-run venture funds has been adopted by universities around the world.

Building on his experience as an attorney at the Federal Reserve, the 2020-22 research of Assistant Professor Jeremy Kress has identified critical weaknesses in bank merger oversight and proposed strategies to reinvigorate bank merger enforcement. Kress' work has shown that lax bank merger oversight has harmed consumers, businesses, and the broader financial system. His research has demonstrated that the prevailing approach to bank merger regulation has increased the cost and reduced the availability of consumer credit, inflated the fees that banks charge for basic financial services, limited small business credit availability, and threatened financial stability. Kress' research has pushed bank merger reform onto the policy agenda in Washington, D.C. by serving as a blueprint for legislation introduced by Senator Elizabeth Warren and inspiring an executive order on bank mergers by President Joe Biden. The Department of Justice also invited Kress to lead a joint initiative with the federal banking agencies to rewrite their bank merger policies.

Previously, it was commonly believed that the media had little role to play in capital markets -- that they neither produced information nor disseminated information in a meaningful manner. Professor Greg Miller questioned this logic and set out to see if there was empirical evidence that would support such an assumption.

Miller found that the business press acted as a corporate watchdog that was instrumental in uncovering financial misconduct. As such, the business press was no longer viewed as talking heads, but as investigative journalism which brought value to the market through the governance role it played. With the more recent introduction of social media, many believed that social media had no role to play in capital markets. A team of researchers from U-M, including Beth Blankespor, Miller, and Hal White, decided to take a novel approach and see if social media could improve capital market outcomes.

Their work was the first to show that social media played an important role in disseminating corporate financial information. Their foundation of research was instrumental in corporate investor relation groups adopting social media to disseminate information to market participants.

In 1999, former Michigan Ross finance faculty member Josh Coval co-authored a paper that is among the top 50 most-cited papers in finance. The paper shows one of the most intriguing patterns in individual behavior. The strong bias in favor of domestic securities is a well-documented characteristic of international investment portfolios, yet this paper shows that the preference for investing close to home also applies to portfolios of domestic stocks. Specifically, U.S. investment managers strongly prefer locally headquartered firms, particularly small, highly leveraged firms that produce nontraded goods. These results suggest that asymmetric information between local and non-local investors may drive the preference for geographically proximate investments, and the relation between investment proximity and firm size and leverage may shed light on several well-documented asset pricing anomalies.

Beginning from seminal efforts by Brian Talbot at the Michigan Business School in the early 1990s, the Tauber Institute for Global Operations was designed to bring business and engineering students together for a world-class education in operations. Students would take classes in both business and engineering and complete team projects with companies. The projects were scoped to incorporate both business and engineering content, addressing important problems that had a VP-level champion at the sponsoring company. The institute was innovative by offering additional training to students beyond operations: leadership training, communications training, and providing students the opportunity to organize conferences, etc. In addition to its impact on students and companies, the Institute has for years served as an important mechanism fueling the technology and operations faculty's relevant, problem-driven research by putting them in touch with practitioners at leading companies around the world. Since its foundation, more than 1,500 graduates have completed the program as Tauber Fellows, there have been 720 summer projects executed at 145 companies, and the Institute was honored in 2012 with the prestigious UPS George D. Smith Prize from INFORMS.

The late 1990s ushered in a revolutionary view across the social sciences centered around the power and importance of studying strengths, better understanding how people thrive, and how systems seize opportunities for creating excellence. Michigan Ross led the way in advancing this fundamental research shift in the field of management and organizations, with many scholars publishing seminal research in the field. In 2002, three faculty members, Jane Dutton, Bob Quinn, and Kim Cameron, founded the Center for Positive Organizations to encourage rigor in this growing field of research and to serve as a home for a large network of scholars interested in pursuing this line of inquiry. As the field has grown over the years, Positive Organizational Scholarship has influenced how management is taught and practiced. CPO at Michigan Ross is a leader in helping teachers and students tap into this body of evidence and learn about this research through innovative courses and developmental learning programs. Those tools include the "Reciprocity Ring", a dynamic group exercise that applies the “pay-it-forward” principle while creating high-quality connections, and the "Reflected Best Self Exercise", which helps you see who you are at your best to engage you to live and work from that powerful place daily.